An Advanced Multi-Agent System for Market Sentiment Analysis and Performance Evaluation

CryptoSentinator v2 is a sophisticated multi-agent system designed to analyze market sentiment for cryptocurrencies. It moves beyond simple sentiment scoring by employing a crew of specialized agents, each with a distinct role: a Scout for data gathering, an Intelligence Analyst for deep contextual analysis (sentiment and topic modeling), a Strategist for formulating actionable market hypotheses, and an Evaluator for providing immediate, automated performance feedback. Orchestrated by LangGraph, the system demonstrates how specialized agentic workflows can produce nuanced, high-quality insights and self-assess their own performance, providing a powerful framework for developing advanced analytical tools.

The proliferation of cryptocurrencies has been accompanied by the rise of dedicated online communities on platforms like X (formerly Twitter), Reddit, and various news outlets. The collective sentiment within these communities can exert significant influence on asset valuation. However, the sheer volume, velocity, and unstructured nature of this data pose a considerable challenge for traders and analysts.

Traditional sentiment analysis tools often rely on simple keyword matching and lexicon-based scoring, failing to capture the nuance, sarcasm, and context inherent in human language. Furthermore, they seldom integrate sentiment data with real-time market data to produce holistic insights.

CryptoSentinator was developed to address these gaps. It is a multi-agent system that automates the end-to-end process of sentiment analysis and market correlation. The primary research objective of this project is to demonstrate the viability of a stateful graph-based architecture (LangGraph) for orchestrating specialized Large Language Model (LLM) powered agents to solve a complex, multi-step financial analysis problem.

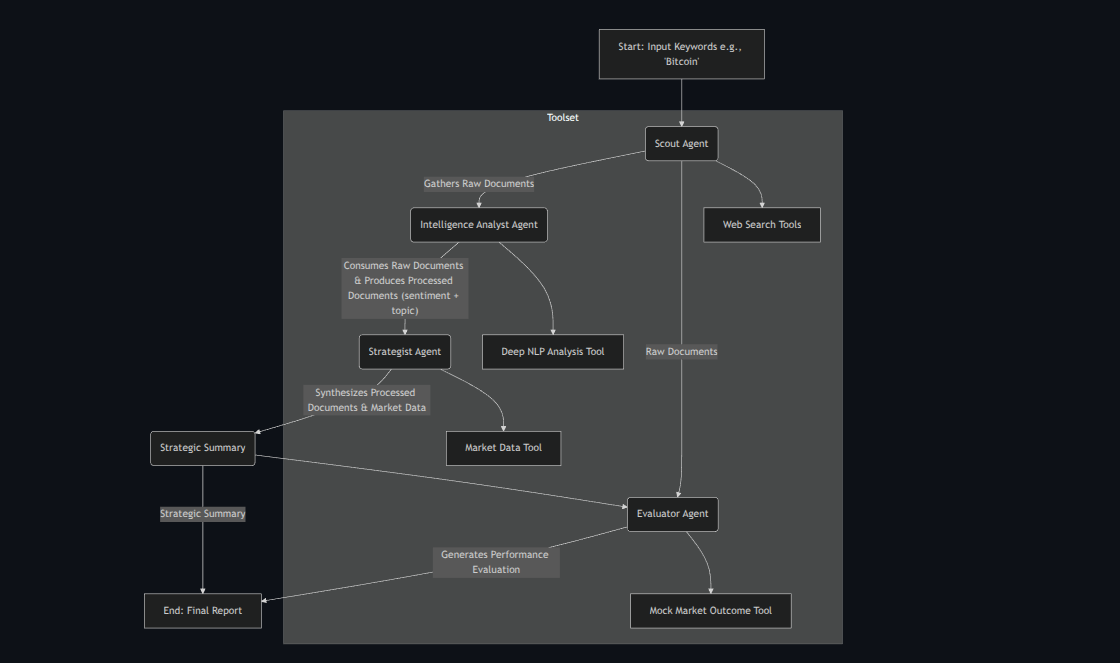

The power of CryptoSentinator v2 lies in its division of labor among four distinct agents, communicating and collaborating through a shared state managed by the LangGraph framework, supported by a dedicated set of tools.

The system executes a linear workflow, ensuring a logical progression from data collection to insight generation.

graph TD

A[Start: Input Keywords e.g., 'Bitcoin'] --> B(Scout Agent);

B -- Gathers Raw Documents --> C(Intelligence Analyst Agent);

C -- Consumes Raw Documents & Produces Processed Documents (sentiment + topic) --> D(Strategist Agent);

D -- Synthesizes Processed Documents & Market Data --> E(Strategic Summary);

E --> F(Evaluator Agent);

B -- Raw Documents --> F;

F -- Generates Performance Evaluation --> G[End: Final Report];

E -- Strategic Summary --> G;

subgraph Toolset

B --> T1[Web Search Tools];

C --> T2[Deep NLP Analysis Tool];

D --> T3[Market Data Tool];

F --> T4[Mock Market Outcome Tool];

end

This stateful, sequential process ensures that each agent has the necessary data to perform its function, creating a transparent and debuggable workflow.

📈 Deep Contextual Analysis: Goes beyond "positive/negative" to understand why the sentiment exists (e.g., "Positive sentiment due to a Technology Update").

🤖 Specialized Agent Roles: A clear demonstration of a multi-agent "crew" where each member has a unique, value-adding role.

📝 Actionable Strategic Hypotheses: Delivers a clear, human-readable market hypothesis, not just raw data points.

🔍 Integrated Performance Evaluation: Features a built-in feedback loop for immediate, automated assessment of the system's accuracy on each run.

🛠️ Extensible Framework: Built with LangGraph, making it easy to add new agents, tools, or modify the workflow.

Technical Requirements

langchain langchain-openai langgraph python-dotenv google-generativeai

To use and extend this tool effectively, a user should have a basic understanding of:

git clone <your-repository-url> cd cryptosentinator-v2

# For macOS/Linux python3 -m venv venv source venv/bin/activate # For Windows python -m venv venv .\venv\Scripts\activate

pip install -r requirements.txt

# .env API_KEY="sk-YourSecret_ApiKey"

The application uses python-dotenv to automatically load this key. Never commit your .env file to a public repository.

The main script is designed to be run as a module from the parent directory. This ensures all relative imports work correctly.

To start an analysis run, execute the following command from the project's root directory:

python -m cryptosentinator.main

You can change the target keywords by editing the target_keywords list inside the if name == "main": block in cryptosentinator/main.py.

The system will print the status of each agent as it runs. The final output consists of two main sections:

{ "cryptocurrency": "Bitcoin", "hypothesis": "Strong bullish sentiment driven by positive discussions on technology updates suggests a potential short-term price increase.", "confidence": "High", "reasoning": "The average sentiment is highly positive, and the dominant discussion topic is 'Technology Update'. This fundamental positivity, combined with a recent stable price, points towards upward potential as the news disseminates.", "supporting_evidence": [ "'Great news for #Bitcoin! To the moon! 🚀 #BitcoinIsTheFuture' (Topic: Price Speculation, Sentiment: 0.90)", "'Major financial news outlet reports on Bitcoin. Experts predict potential volatility...' (Topic: General Market Trend, Sentiment: 0.10)" ] }

{ "cryptocurrency": "Bitcoin", "hypothesis_tested": "Strong bullish sentiment driven by positive discussions on technology updates suggests a potential short-term price increase.", "simulated_outcome": "Positive price movement (+5.72%)", "evaluation_result": "Correct", "evaluation_notes": "The hypothesis correctly predicted the direction of the simulated market movement." }

A robust system must anticipate and handle failures gracefully. CryptoSentinator v2 has several mechanisms in place.

This project relies on external libraries and APIs. Regular maintenance should include:

CryptoSentinator serves as a successful proof-of-concept, demonstrating that a multi-agent architecture orchestrated by LangGraph can effectively automate the process of market sentiment analysis. It lays the groundwork for more sophisticated AI-driven financial tools.

While this implementation relies on mock data to establish the framework, future work will focus on transitioning it into a production-ready system. Key areas for development include:

In conclusion, CryptoSentinator illustrates a powerful paradigm for building intelligent systems capable of navigating complex information ecosystems. The principles demonstrated here are not limited to cryptocurrency and can be adapted to various domains requiring the synthesis of public sentiment with domain-specific data.