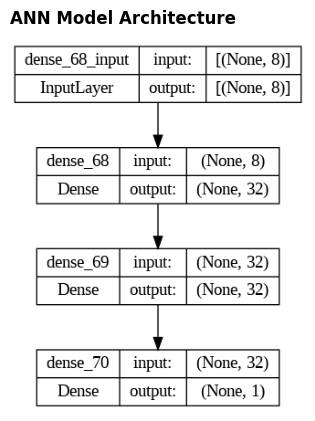

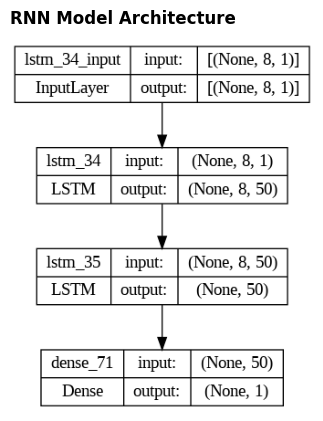

AI-DOT is an intelligent options trading bot developed using Artificial Neural Networks (ANN) and Recurrent Neural Networks (RNN). It automatically analyzes options data, generates call/put buy/sell signals, and integrates with broker APIs for real-time execution. This project demonstrates the full pipeline from data acquisition to model training, evaluation, signal generation, and live deployment.

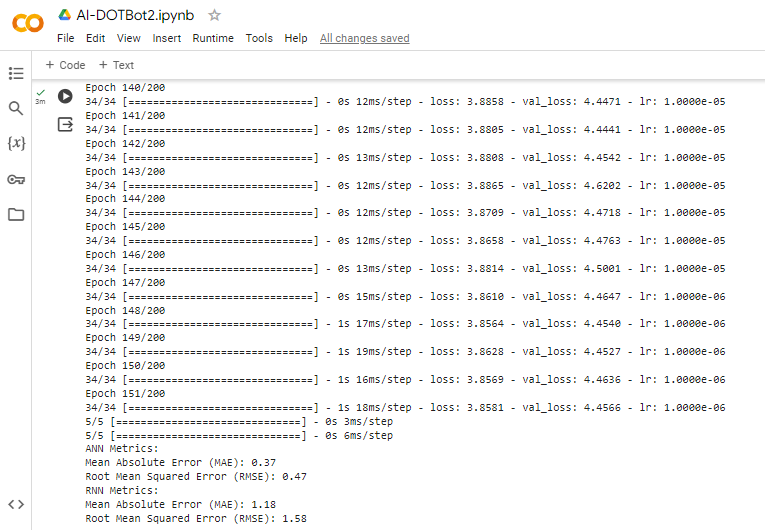

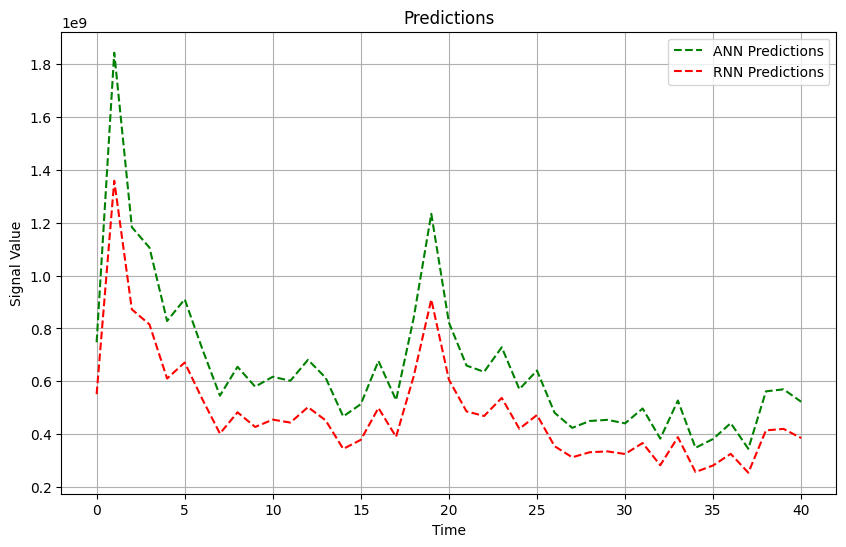

| Model | MAE | RMSE |

|---|---|---|

| ANN | 0.37 | 0.47 |

| RNN | 1.18 | 1.58 |

ANN outperformed RNN in both accuracy and consistency. RNN showed stable learning but struggled with prediction precision.

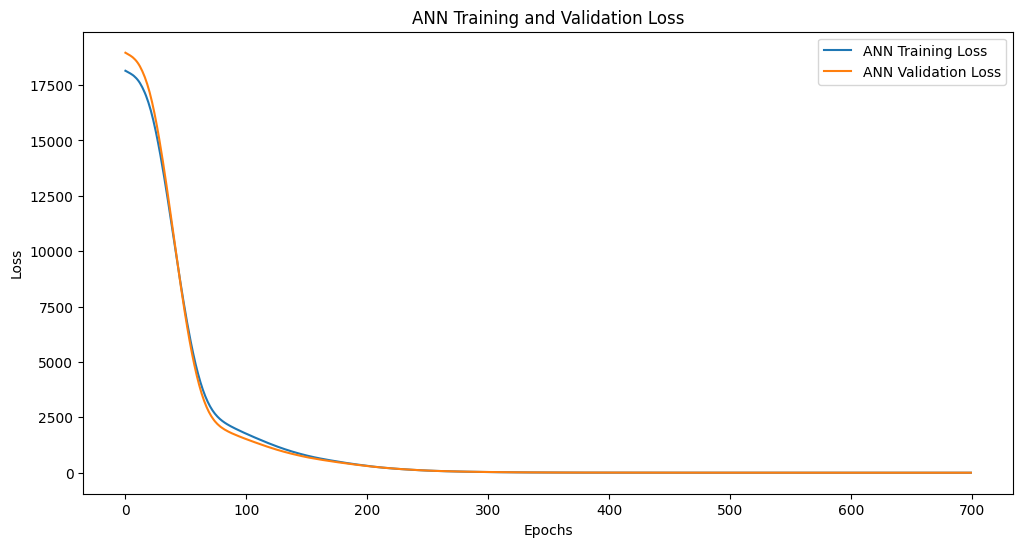

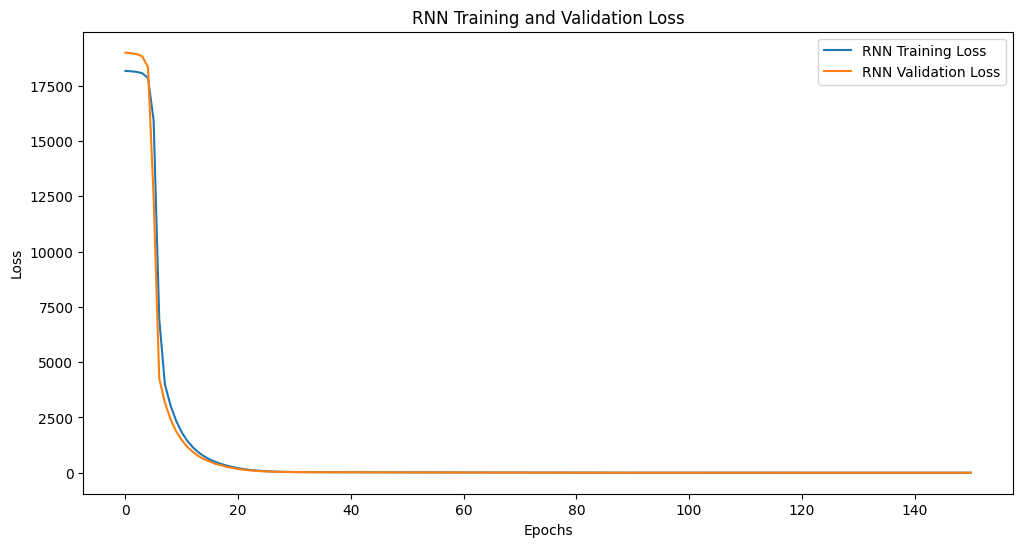

Training and validation loss decreased smoothly with no overfitting observed.

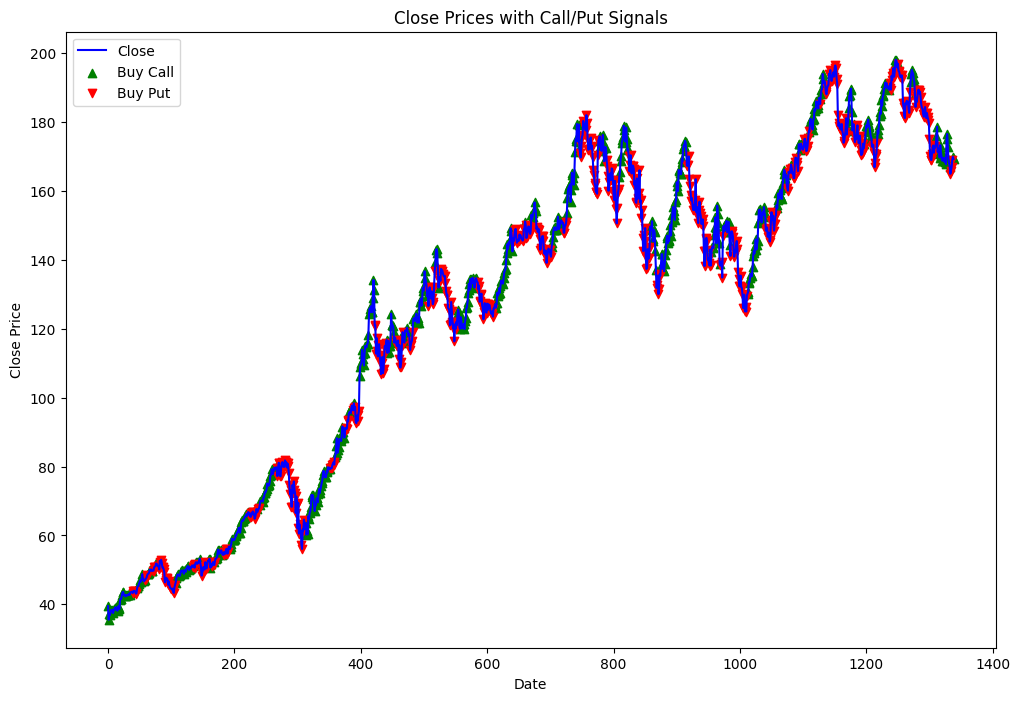

The trained models were used to generate trading signals:

Signals were overlaid on live price charts for intuitive visualization and backtesting.

| Test Stage | Status |

|---|---|

| Data preprocessing and cleaning | ✅ Passed |

| ANN & RNN Model training | ✅ Passed |

| Model validation with MAE & RMSE | ✅ Passed |

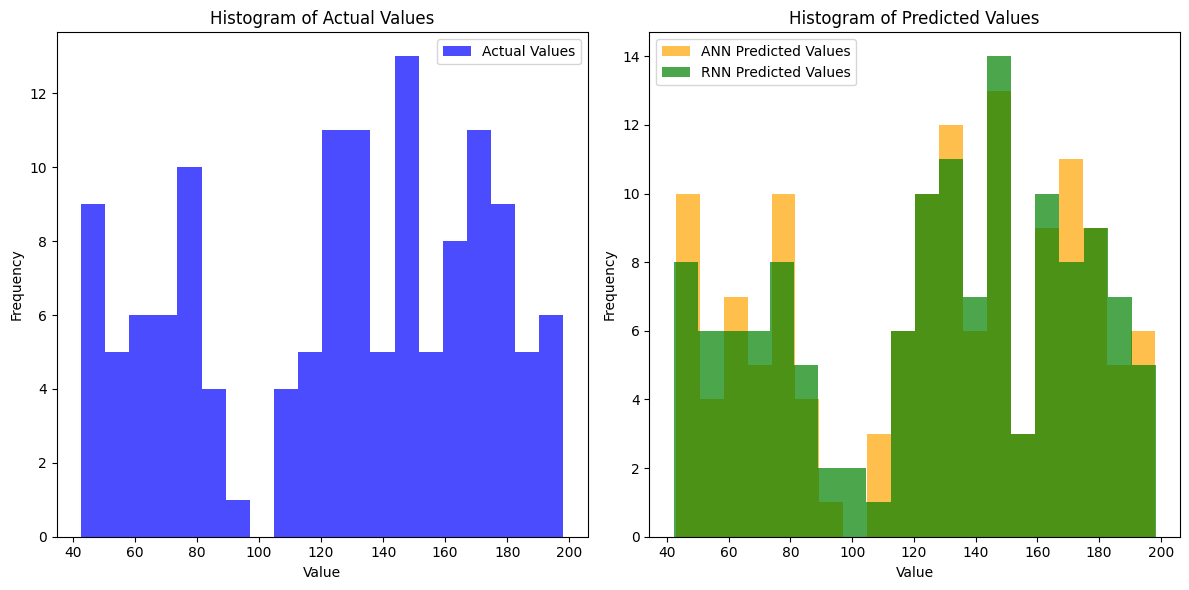

| Prediction histogram and alignment | ✅ Passed |

| Signal generation from model outputs | ✅ Passed |

| Visual verification of trading points | ✅ Passed |

Malaviya, A., Dhumale, N., Kotian, N., & Vala, J. (2024). AI-DOT: Artificial Intelligence Driven Options Trading Bot. Shah and Anchor Kutchhi Engineering College.