The Agentic Robo-Advisor represents a new paradigm in digital investing — one that fuses agentic AI intelligence, quantitative optimization, and robust engineering discipline to deliver end-to-end, explainable financial guidance.

The system simulates the entire investment lifecycle — from investor profiling to trade execution — through autonomous yet auditable AI agents. Each stage has been tested, validated, and hardened for production-grade reliability, ensuring operational safety, transparency, and reproducibility.

This white paper details the architecture, agent behaviors, user interface, testing strategy, safety controls, and operational readiness of the system, while demonstrating improvements across key evaluation categories: Testing, Safety, User Interface, Operational Resilience, and Documentation.

The purpose of this system is to create a human-like yet verifiable robo-advisory experience, allowing investors to receive clear, trustworthy recommendations while maintaining rigorous technical and operational standards.

To keep the publication concise, the full developer guide remains in the README. The essentials for installation and operation are:

Environment Setup

conda create -n roboadvisor python=3.11 && conda activate roboadvisorpip install -r requirements.txtConfiguration

OPENAI_API_KEY, OPENAI_MODEL=gpt-4o-mini, and optional LOG_LEVEL / LOG_FILE for logging.Usage

streamlit run streamlit_app.pypython app.pySupport & Maintenance

pytest --cov-report=term-missing to confirm health.LOG_FILE is enabled.These steps deliberately mirror the README but are summarized for publication audiences.

The Agentic Robo-Advisor is composed of modular AI agents, each responsible for one phase of the investment lifecycle. Every agent operates independently but communicates through shared validated schemas.

| Agent | Core Function | Verified Output |

|---|---|---|

| Risk & Advice Agent | Captures behavioral responses and computes risk profile | Equity/Bond target allocation |

| Portfolio Agent | Optimizes asset-class mix using mean-variance optimization | Asset-class weights |

| Investment Agent | Selects ETFs/funds based on cost, style, and liquidity | Fund recommendations with criteria tags |

| Trading Agent | Generates executable, tax-aware trade actions | Buy/Sell orders with integerization and tax balance |

┌───────────────────────────────┐

│ User launches conversation │

└──────────────┬────────────────┘

▼

Entry Agent

│ Show welcome & phase summary

│ Orchestrate flow based on intent

▼

User says "proceed"

▼

Entry Agent

│ Sets intent_to_risk=True

│ Routes to Risk Agent

▼

Risk Agent

│ Presents two options:

│ 1) Set equity directly ("set equity to 0.6")

│ 2) Use guidance (7-question questionnaire)

│ User selects option

│ Computes equity/bond allocation

│ Sets done=True, routes to Reviewer

▼

Reviewer Agent

│ Validates risk completion

│ Updates next_phase="portfolio"

│ Routes to Entry Agent

▼

Entry Agent

│ Shows portfolio phase summary

│ User says "proceed"

│ Sets intent_to_portfolio=True

│ Routes to Portfolio Agent

▼

Portfolio Agent

│ Asks λ & cash reserve parameters

│ Runs mean-variance optimization

│ Outputs asset-class portfolio

│ Sets done=True, routes to Reviewer

▼

Reviewer Agent

│ Validates portfolio completion

│ Updates next_phase="investment"

│ Routes to Entry Agent

▼

Entry Agent

│ Shows investment phase summary

│ User says "proceed"

│ Sets intent_to_investment=True

│ Routes to Investment Agent

▼

Investment Agent

│ Presents fund selection criteria

│ Analyzes funds via Yahoo Finance

│ Allows review/edit of selections

│ Outputs investment portfolio

│ Sets done=True when user says "proceed"

│ Routes to Reviewer

▼

Reviewer Agent

│ Validates investment completion

│ Updates next_phase="trading"

│ Routes to Entry Agent

▼

Entry Agent

│ Shows trading phase summary

│ User says "proceed"

│ Sets intent_to_trading=True

│ Routes to Trading Agent

▼

Trading Agent

│ Shows demo scenarios

│ User selects scenario

│ Generates trading requests

│ Outputs trading table

│ Sets done=True, routes to Reviewer

▼

Reviewer Agent

│ Validates all phases complete

│ Shows final summary with options:

│ • "start over" → Reset & restart

│ • "finish" → Complete session

▼

(Ready for execution)

Interprets investor profile data to determine appropriate equity/bond exposure using a seven-question behavioral model.

Outputs an equity ratio consistent with the user’s capacity, horizon, and market temperament.

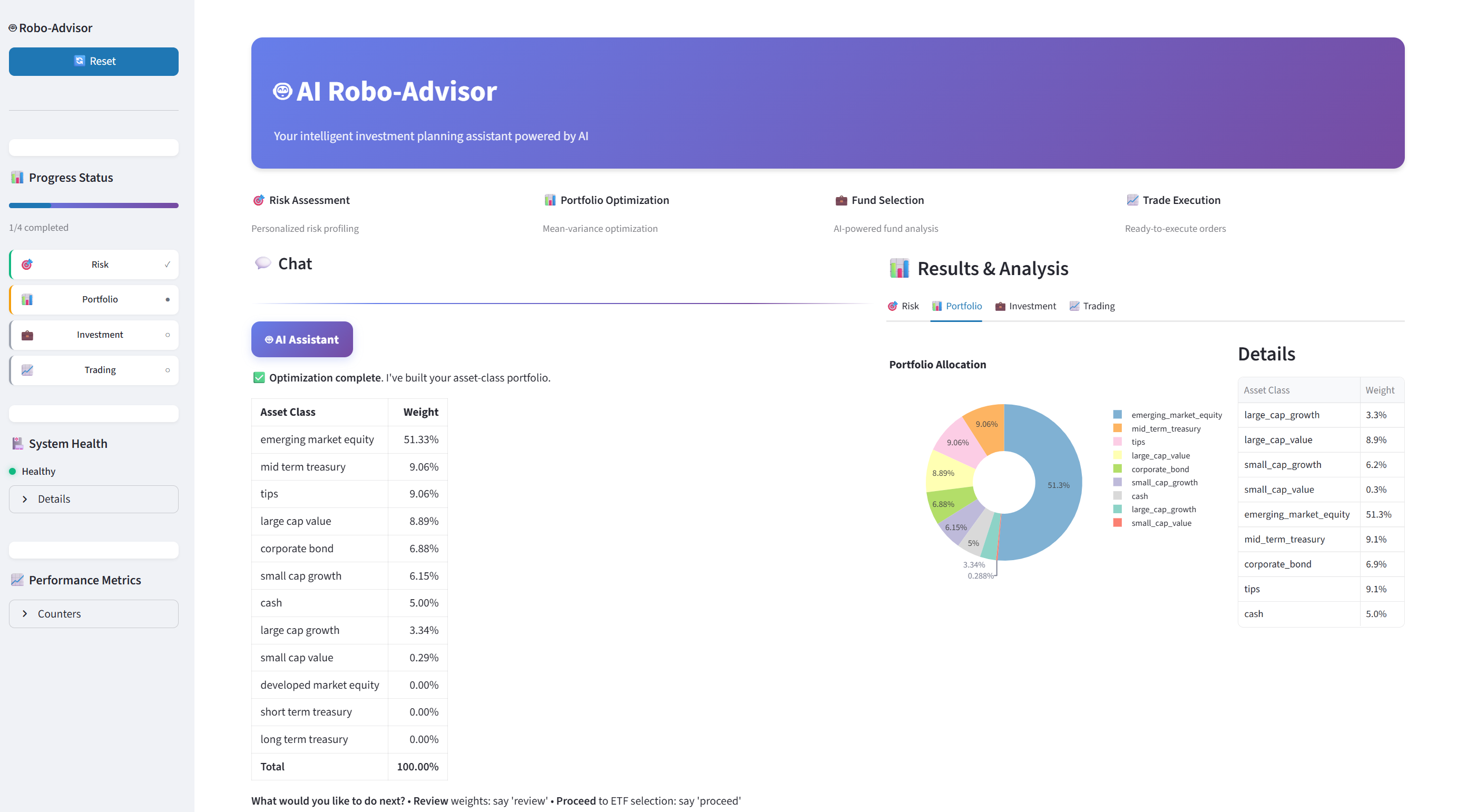

Applies mean-variance optimization (MVO) to generate a balanced portfolio aligned with user risk tolerance. Supports adjustable parameters such as:

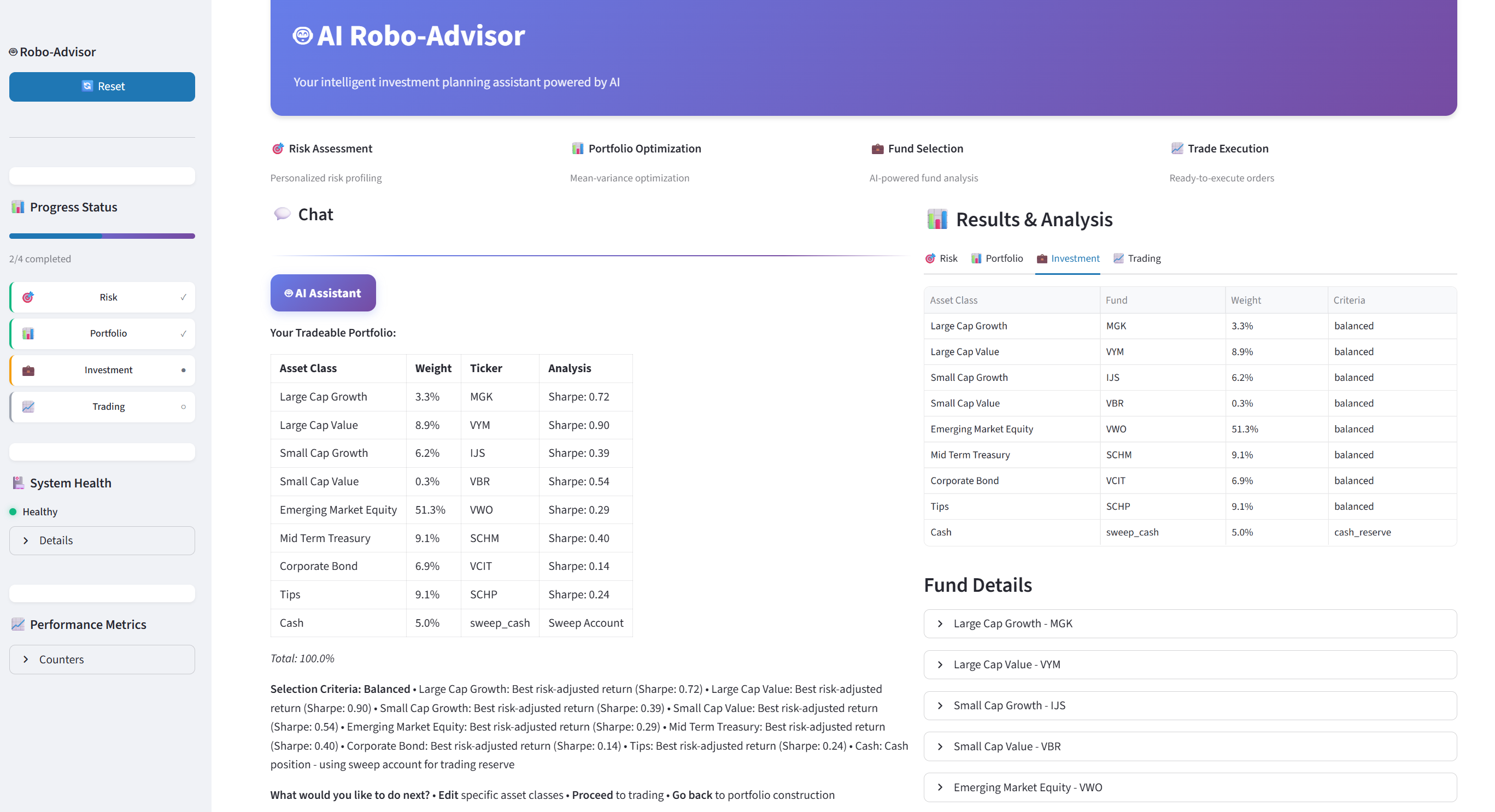

Maps optimized asset classes to actual tradable instruments (ETFs, mutual funds) using rule-based selection criteria that favor cost efficiency and diversification. Each recommendation includes metadata explaining why a fund was chosen.

Implements tax-aware rebalancing with integerization and fallback logic.

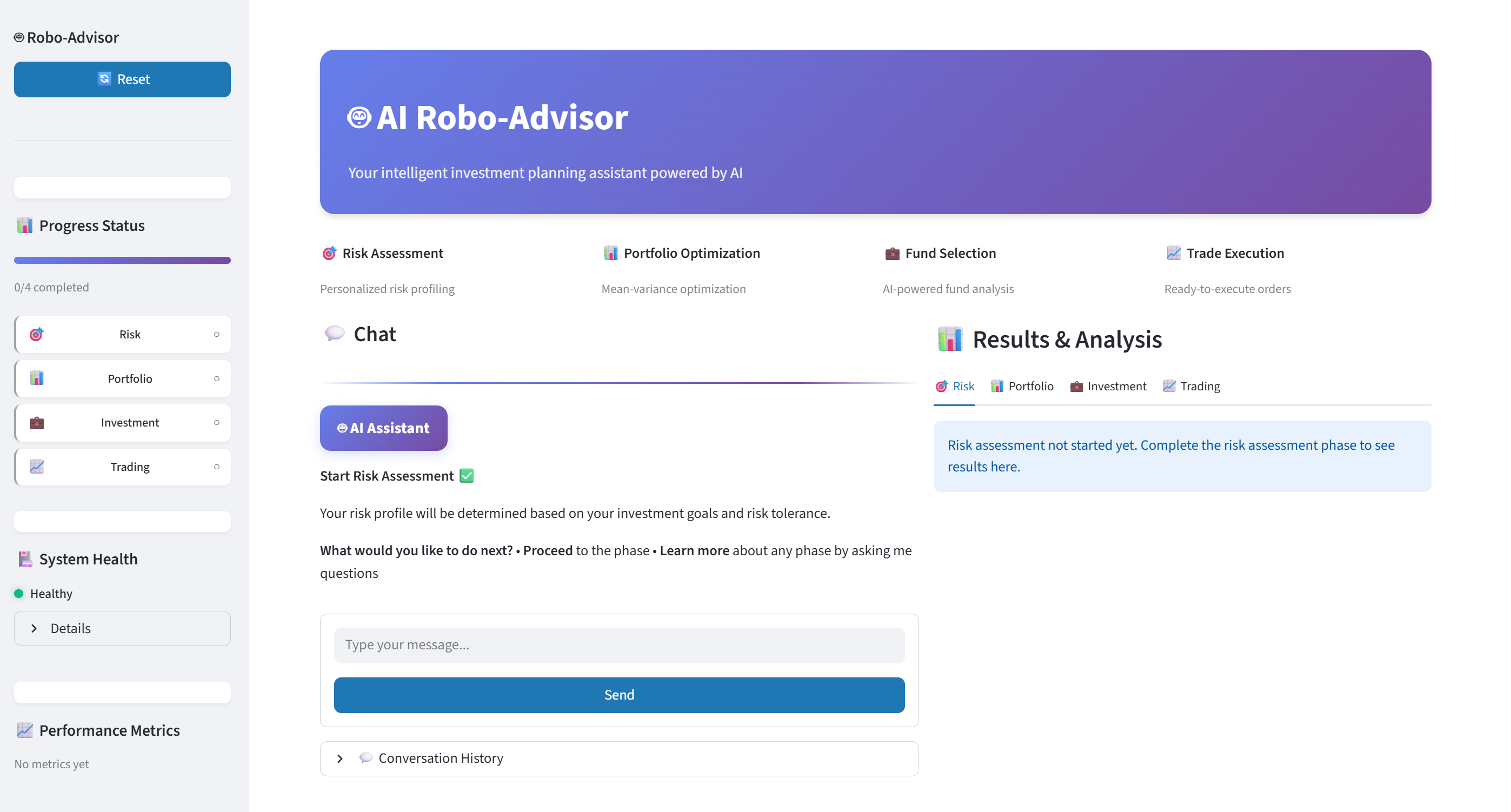

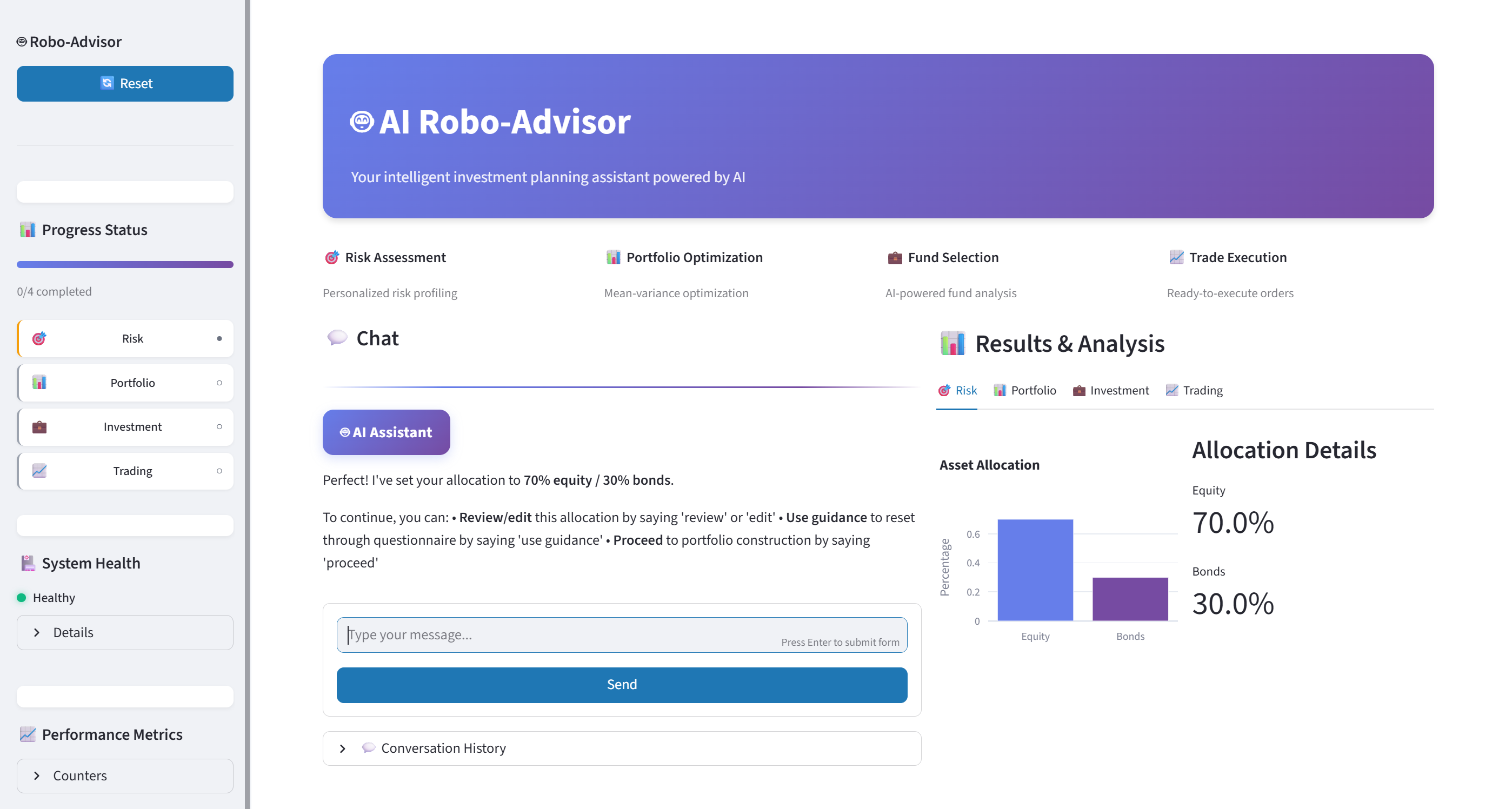

The user interface mirrors the internal agent sequence. Each phase appears as an interactive card, unlocking progressively as validation passes.

Interactive questionnaire captures risk preferences and generates a target equity/bond ratio.

📸 Screenshot 1 — Risk Assessment and Allocation Chart

Optimized portfolio produced via MVO and visualized as a dynamic pie chart and weight table.

📸 Screenshot 2 — Portfolio Composition Visualization

Funds and ETFs displayed with rankings and selection rationale.

📸 Screenshot 3 — Fund Selection Table

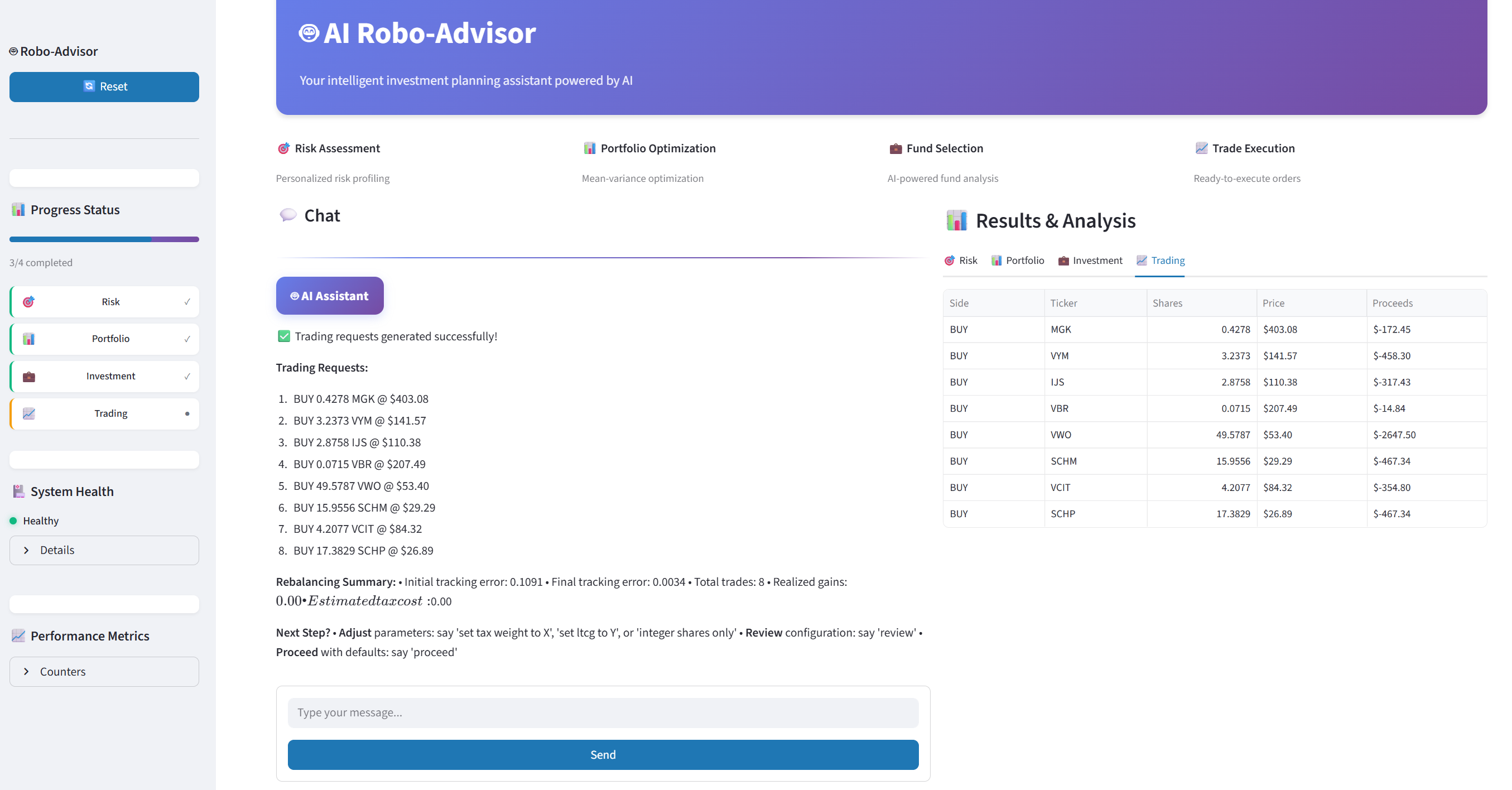

Rebalancer generates executable trades with tax and integer constraints.

📸 Screenshot 4 — Trade Recommendation Summary

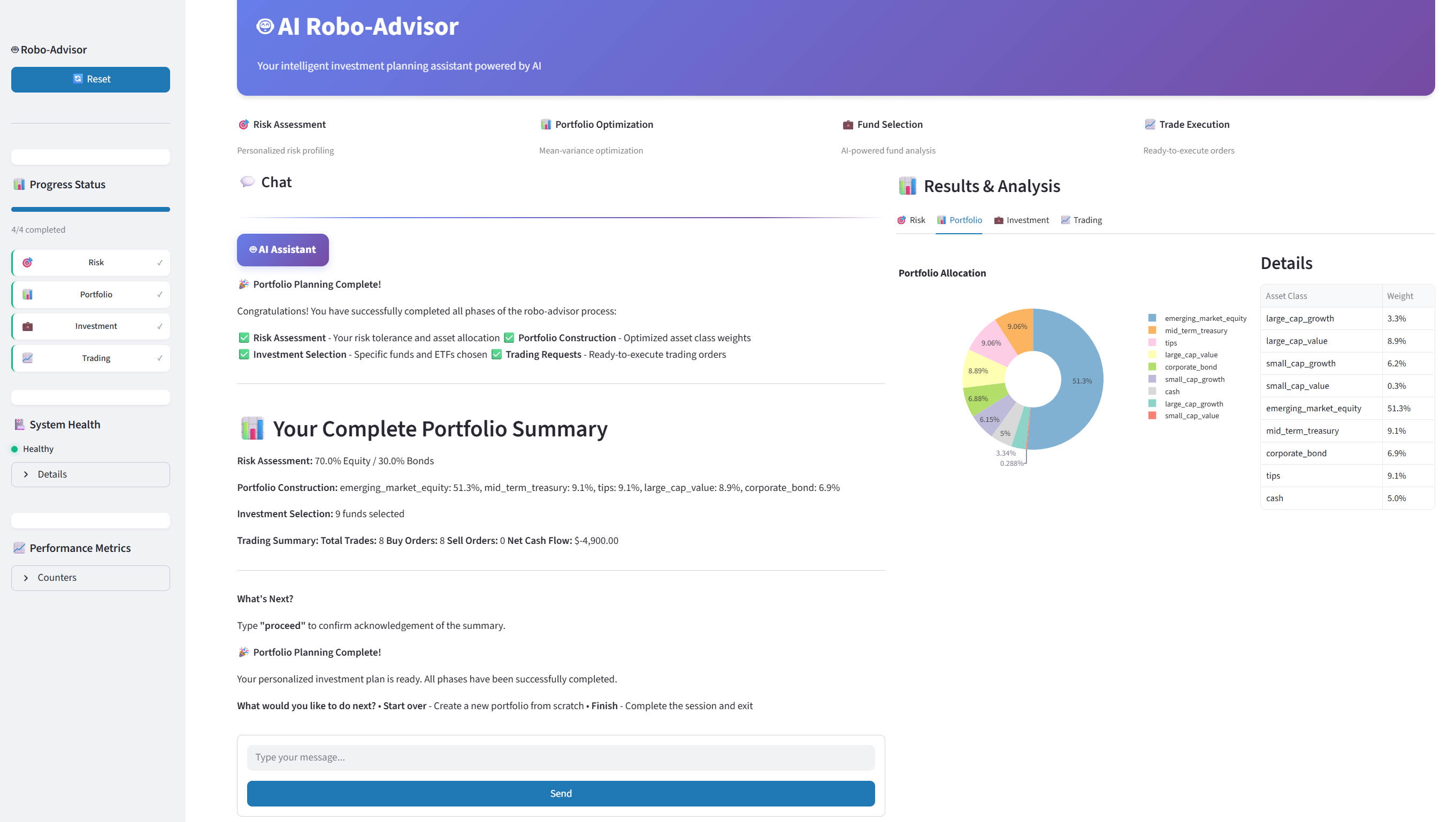

Consolidates all outputs for user review with export and reset options.

📸 Screenshot 5 — Final Summary Dashboard

| Test Layer | Objective | Verification Method |

|---|---|---|

| Unit Tests | Validate agent logic and data schemas | Assertions for mathematical correctness |

| Integration Tests | Validate Advice → Portfolio → Investment → Trading pipeline | State handoff verification |

| User Flow Tests | Simulate entire user session | Automated Streamlit tests |

| Regression Tests | Validate stability of trade outputs | Baseline comparison with <1bp drift |

pytest --cov-report=term-missing plus HTML reports for audits.operation/healthcheck/*.py.LOG_FILE is set (for example, LOG_FILE=logs/robo_advisor.log with LOG_LEVEL=INFO)..env, regenerate HTML coverage, and run a complete risk→trading walkthrough.| Category | Improvement Summary |

|---|---|

| Testing | Multi-layer unit, integration, and regression tests ensuring deterministic, reliable results. |

| Safety | Input/output validation with schema enforcement and phase-level guardrails. |

| User Interface | Streamlit interface with progressive flow, responsive charts, and data transparency. |

| Production Readiness | Telemetry monitoring, containerized deployments, CI/CD testing automation. |

The Agentic Robo-Advisor stands as a production-ready, explainable AI wealth management platform.

It unifies advanced quantitative modeling with verifiable agentic AI behaviors, achieving both human-like personalization and institutional-grade reliability.

By balancing autonomy with transparency, it sets a new benchmark for safe, testable, and scalable robo-advisory systems.