Overview

PayZapp, launched by HDFC Bank, is a comprehensive mobile payment platform designed to facilitate digital transactions in India. With a user-friendly interface, PayZapp allows customers to make payments for various services such as utility bills, mobile recharges, online shopping, and ticket bookings—all from one app. Additionally, PayZapp supports peer-to-peer (P2P) transactions, enabling users to send and receive money effortlessly among friends and family. As India embraces digital payments, PayZapp aims to provide a seamless and secure user experience.

In this project, we leveraged Generative AI to analyze customer reviews of PayZapp 2.0. By examining over 22,432 reviews from the Android Play Store, we aimed to identify common pain points, gauge user sentiment, and provide actionable recommendations for product improvements.

Objective

The primary objective of this project was to employ advanced analytics and AI technologies to derive meaningful insights from user feedback regarding PayZapp. Specifically, we aimed to:

• Identify Key Pain Points: Uncover recurring issues that users face while using the app, such as payment failures, technical glitches, and difficulties during registration.

• Highlight Positive Experiences: Recognize aspects of the app that users appreciate, which can be leveraged to enhance marketing strategies and user engagement.

• Inform Product Development: Provide the product development team with data-driven recommendations for specific features and functionalities that can improve overall user satisfaction.

• Create a Strategic Roadmap: Develop a framework for ongoing enhancements based on user feedback, ensuring that future updates align with customer needs and expectations.

Implementation:

The implementation phase involved a systematic approach to analyzing user feedback using Generative AI:

- Data Collection: We scoured the Android Play Store and extracted customer reviews of PayZapp. The dataset consisted of over 2.69 lakh ratings/reviews, with approximately 10% containing detailed feedback regarding user experiences.

- Data Pre-processing: To ensure data quality, the reviews underwent several pre-processing steps:

• Text Cleaning: Standardized text by removing special characters, URLs, and irrelevant content.

• Sentiment Analysis: Classified reviews into positive, negative, and neutral categories using natural language processing techniques.

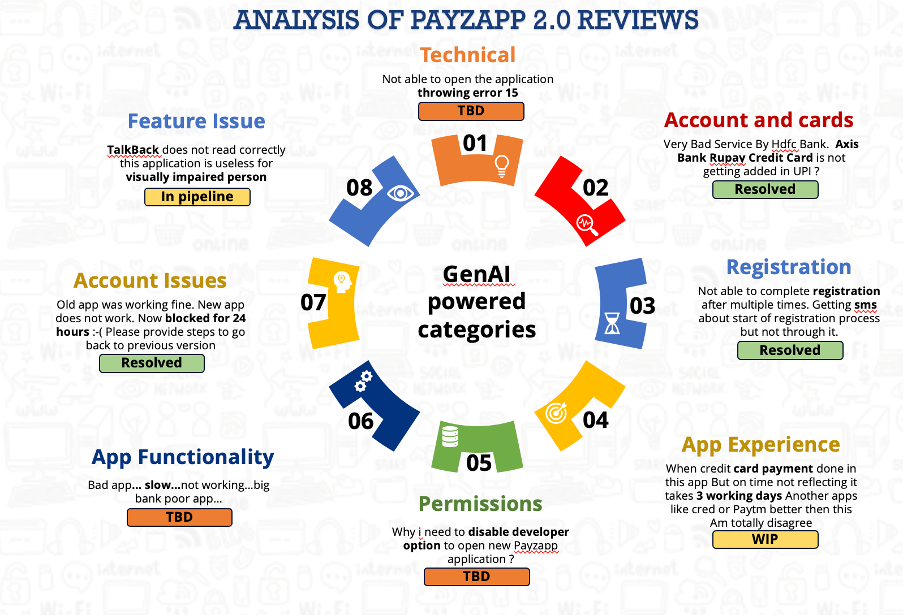

• Thematic Categorization: Leveraged GenAI to identify categories such as payment processing issues, technical errors, accessibility concerns, and feature requests. - Thematic Analysis: Reviews were analyzed for recurring themes, highlighting specific categories:

• Payment Processing Issues: Problems related to transaction failures and delays.

• Technical Errors: Issues like Error 15 affecting app functionality.

• Accessibility: Feedback from visually impaired users about accessibility challenges.

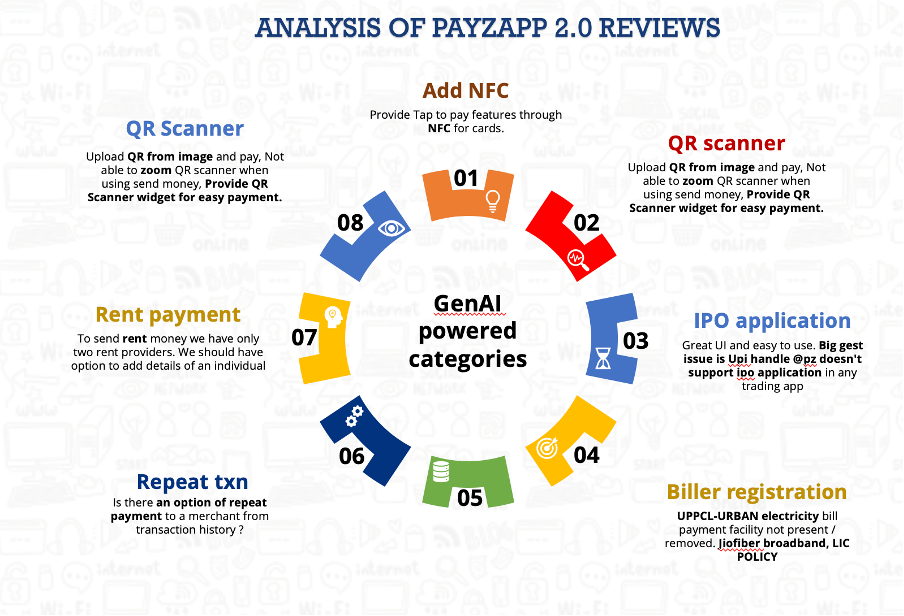

• Feature Requests: Suggestions for enhancements, such as NFC support for payments and transaction history visibility. - Engagement with Development Teams: Regular meetings with the PayZapp development and product teams were conducted to share insights from our analysis. This collaboration ensured prioritization of user feedback.

- Feature Prioritization: Based on insights gathered, we assisted the product team in creating a roadmap for enhancements, addressing high-priority issues first.

- Implementation of Changes: Following the analysis, the team implemented several improvements, including:

• Resolution of the issue with adding Axis Bank Rupay cards.

• Fixing SMS registration failures.

• Addressing the error 15 problem for better app functionality.

• Introducing new features, such as NFC payments and enhanced transaction visibility.

7.Continuous Monitoring: After implementing changes, a system for ongoing monitoring of user feedback was established to assess the impact of enhancements.

Impact:

This project has had a significant impact on PayZapp’s performance and user satisfaction levels. Key impacts include:

- Enhanced User Satisfaction: Critical issues, such as the inability to add Axis Bank Rupay cards and SMS registration failures, have been resolved, leading to improved user experiences.

- Increased Engagement: The introduction of new features like NFC payments and improved transaction visibility has resulted in higher app engagement.

- Proactive Issue Resolution: The framework for continuous monitoring enables the PayZapp team to respond quickly to emerging issues, improving overall app reliability.

- Strategic Insights for Future Development: Insights from this project provide a robust foundation for future product enhancements, ensuring PayZapp remains competitive in the digital payments landscape.

- Long-term Vision: The successful integration of AI-driven analytics into product development has set a precedent for future initiatives, promoting a culture of continuous improvement.

In conclusion, this project demonstrated the powerful impact of using Generative AI to analyze customer feedback. The insights gathered have enhanced user experience and strengthened PayZapp’s overall product strategy, positioning it for sustained growth and success.

Democratization of AI:

Building on the success of our analysis for PayZapp, we expanded our efforts to include SmartHub Vyapar, a mobile payment platform also under HDFC Bank. SmartHub Vyapar is designed for merchants, enabling them to accept digital payments seamlessly through various channels. With over 137,000 ratings and reviews available on the Android Play Store as of December 2023, we focused on the 64,000 detailed reviews that provided insights into user experiences.

In our analysis, we specifically examined 14,815 reviews rated from 1 to 4 stars, along with a selection of 5-star reviews. This comprehensive approach allowed us to identify key pain points and opportunities for enhancement across several critical areas:

-

Features Issues:

Users reported significant challenges with the SMS Pay functionality, noting that it was frequently inoperative. Sample feedback highlighted frustrations such as:

"SMS Pay not working; I've complained about this issue, but it remains unresolved."

"Unable to collect payment; it says payment mode not available."

Status: The team is actively working on fixing this issue. -

Technical Challenges:

Many users expressed dissatisfaction with the Tap and Pay feature. Reviews indicated that recent updates had removed this option, leading to uninstallation threats from users. For example:

"The app forced me to update, and since then, the option to accept debit/credit card payments has been removed."

Status: This feature has since been rolled back. -

Instant Settlement Issues:

Users expecting quick settlements voiced their disappointment, stating that this crucial service was no longer available. Feedback included:

"I opted for SmartHub Vyapar for faster services, but instant settlement is not available, and customer care has no answers."

Status: The instant settlement feature is now enabled by default. -

Voice Notification Problems:

Users reported irregularities in the voice notification feature, with many noting that they no longer received alerts when payments were made. Comments such as:

"Payment notifications don’t come up; I have to check the app every time."

Status: The team is currently working on fixing this issue.

Through this initiative, we not only addressed the needs of SmartHub Vyapar users but also fostered a culture of continuous improvement across multiple platforms. By harnessing Generative AI, we have democratized access to advanced analytics, empowering product teams to act swiftly on user feedback. This approach ensures that our digital payment solutions remain user-centric, effectively responding to the evolving demands of our customer base.