Overview

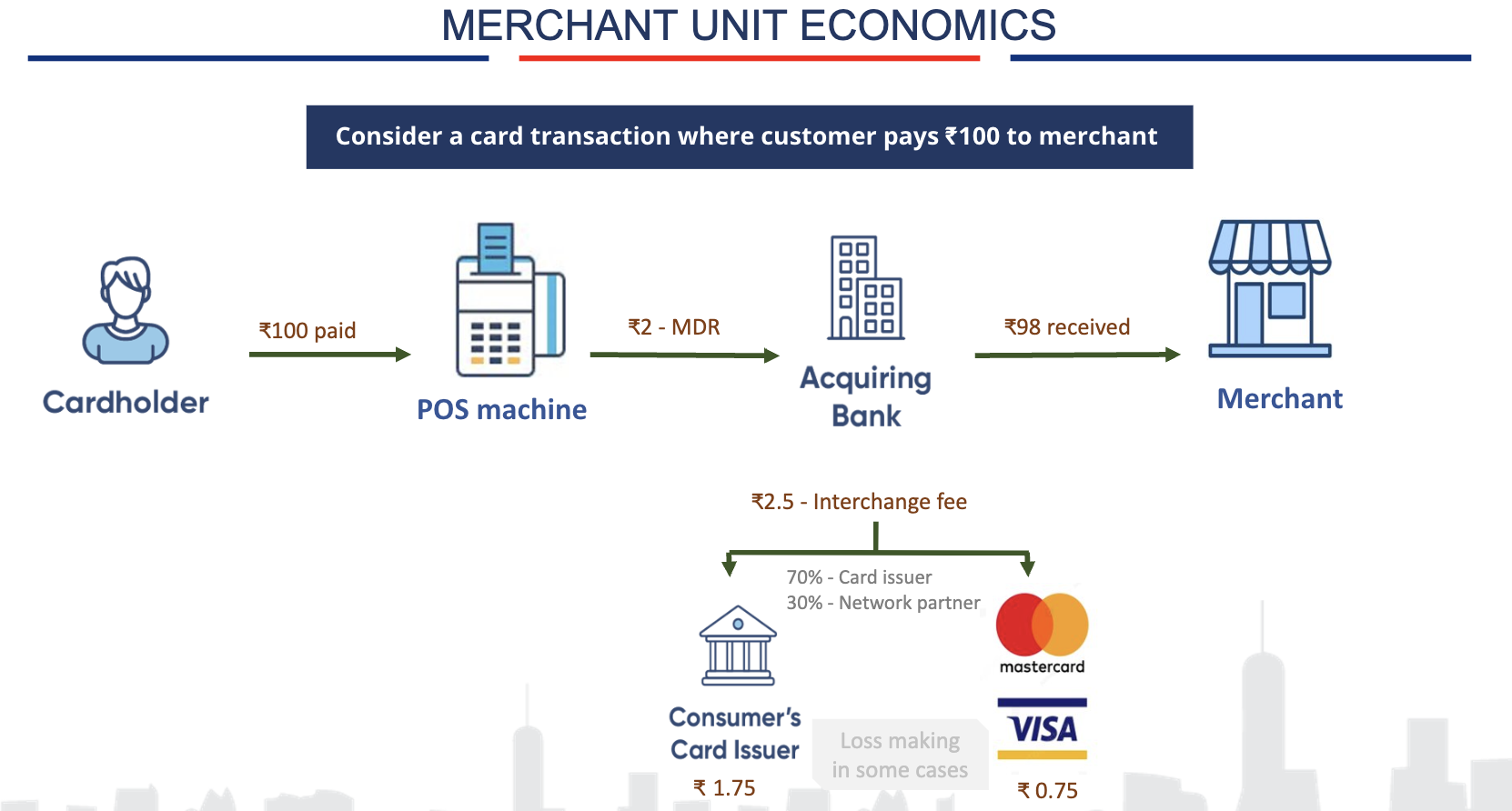

In the competitive landscape of payment processing, banks and POS(point of sale) issuers face the challenge of offering competitive Merchant Discount Rate (MDR) while ensuring profitability. A miscalculation in MDR can lead to significant losses for banks, especially in a market where SMEs rely heavily on POS systems for transactions. The risk is amplified when MDR fail to reflect transaction volumes, interchange fees, and associated operational costs.

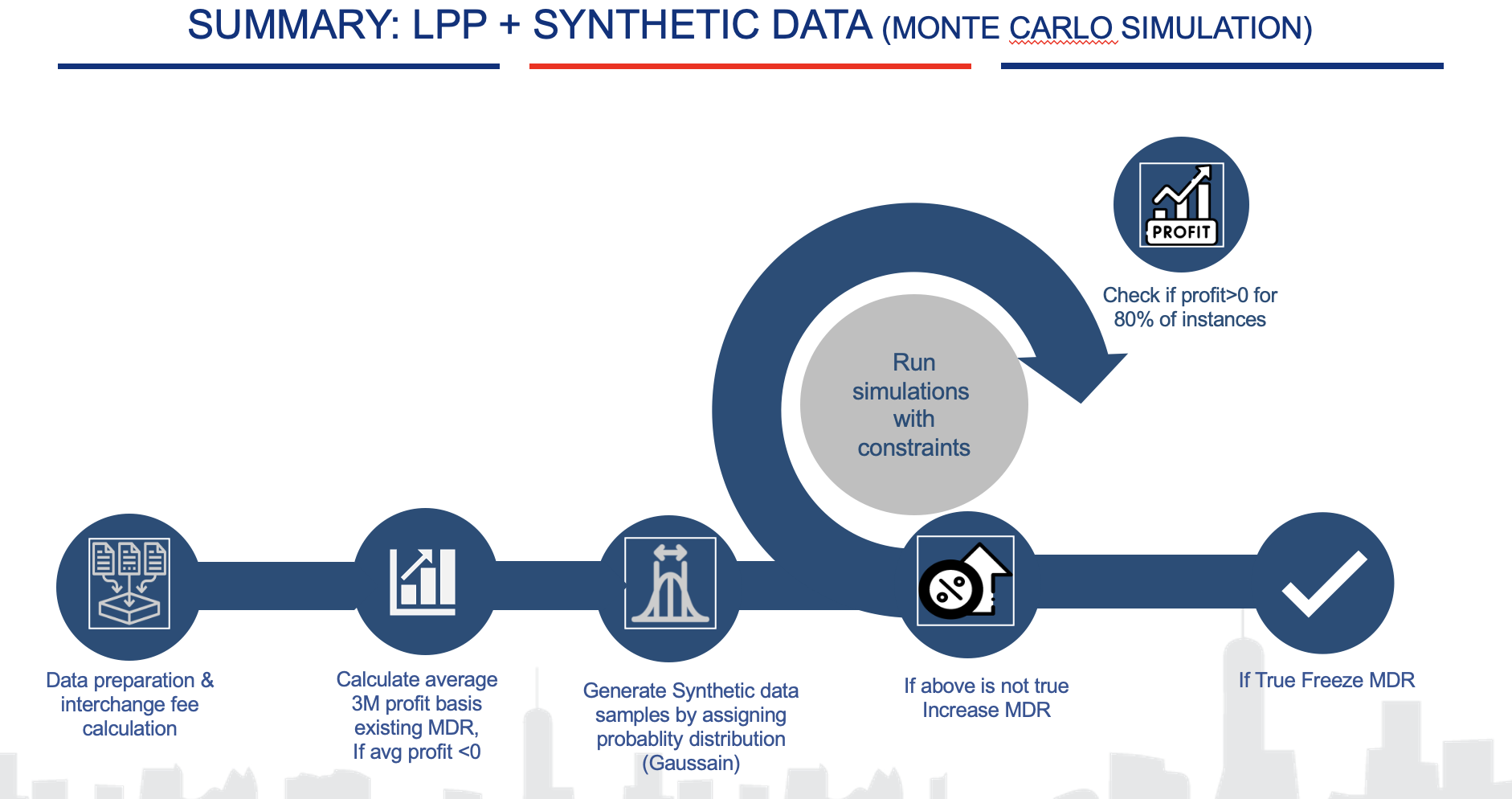

This study addresses optimisation of MDR by analysing transaction data and employing Monte Carlo simulations using Gaussian distributions. The goal is to balance merchant competitiveness and profitability for banks, ensuring that at least 80% of simulated scenarios result in positive financial outcomes.

Datasets

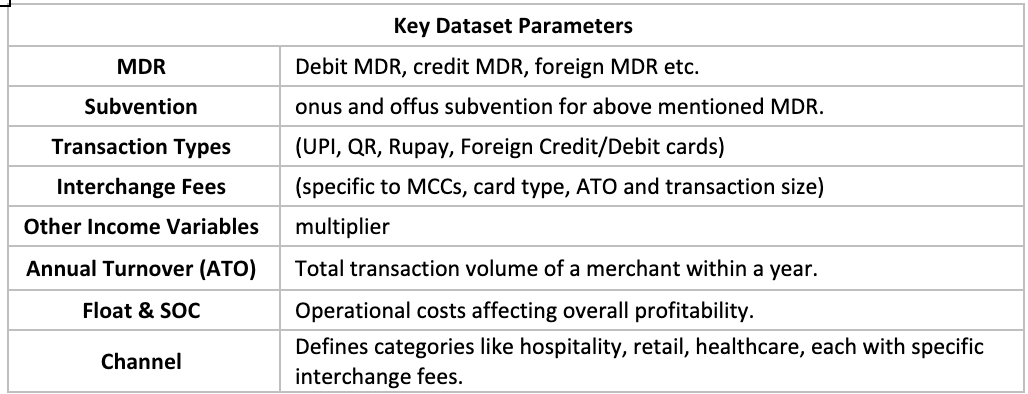

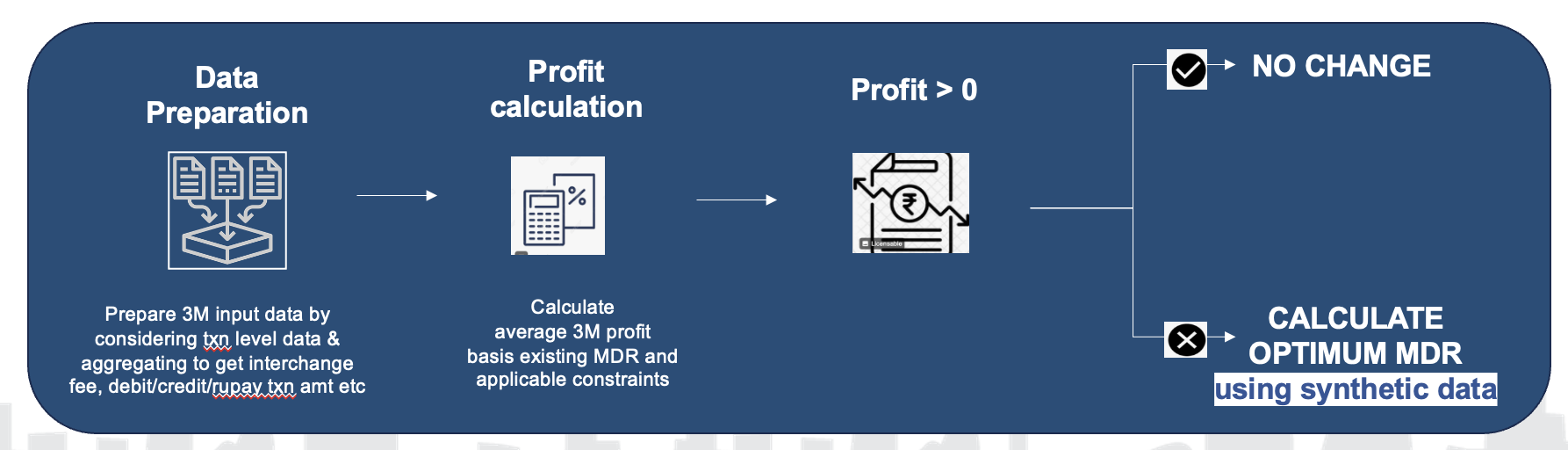

To achieve robust MDR optimization, we used transactional data from merchants spanning over 3 months. The datasets include key variables such as:

Methodology

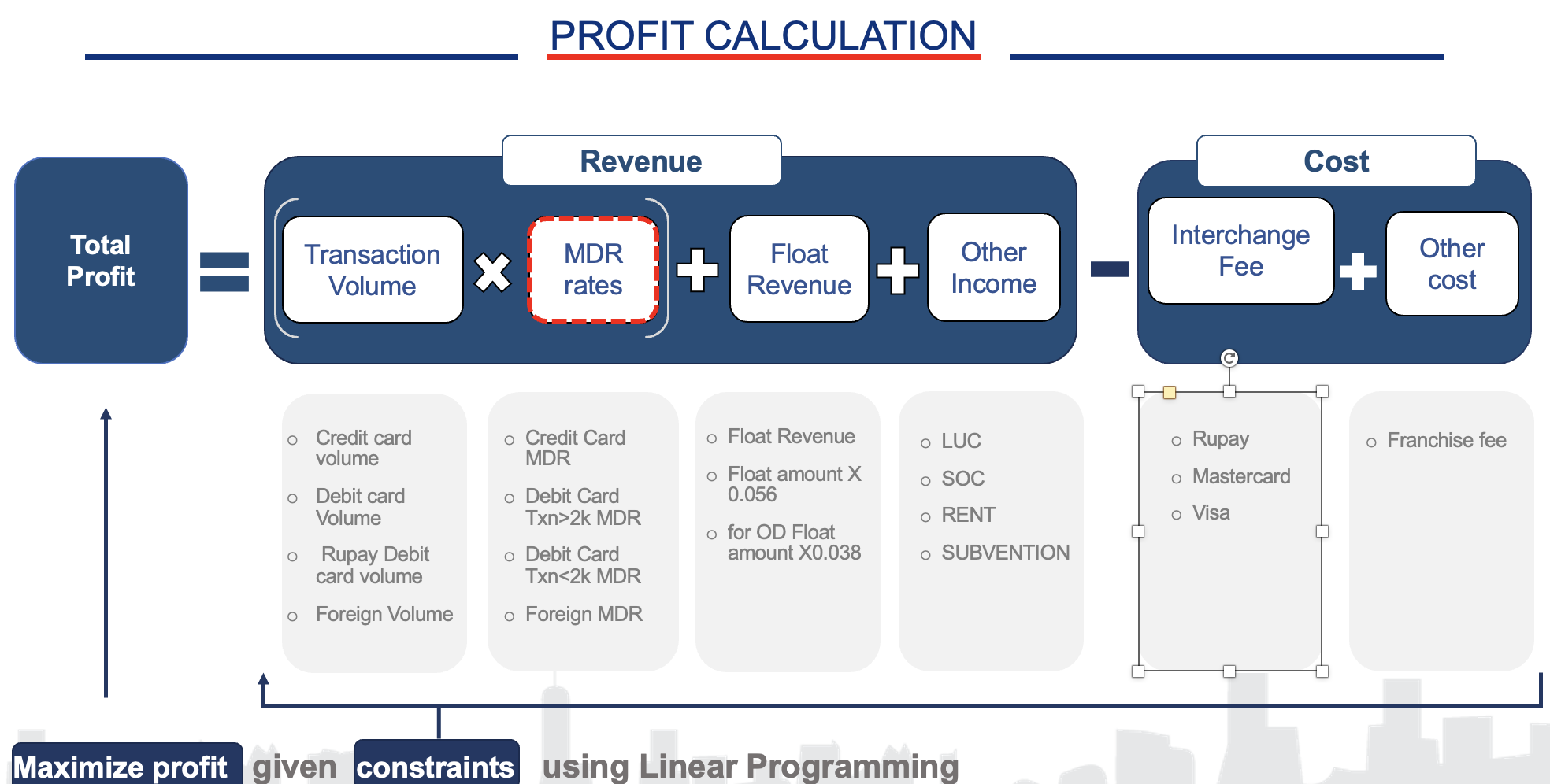

The study utilises a Monte Carlo simulation approach, leveraging Gaussian distributions to generate synthetic input data, for forecasting profitability under varying MDR including extreme scenarios. We employed linear programming to model the relationship between MDR, transaction volumes, and profitability. These simulations allowed us to evaluate the impact of incremental MDR (in basis points) on the overall profitability for bank.

Core Process:

- Data Preprocessing & Fee Calculation:

The transaction dataset was cleaned and categorized by transaction type (debit, credit, foreign), and variables such as rental, SOC(schedule of charges), and other income were calculated. Interchange fees was calculated based on MCC category, ATO (Annual Turnover), transaction size, and card type (e.g., Debit-Visa, Credit-Master) etc.

- Profit Calculation & Monte Carlo Simulation:

Using a linear programming model, the average 3-month profit for each merchant was calculated. Thousands of scenarios were then simulated with Gaussian distributions to assess the impact of incrementally changing (1 basis point) MDR on profitability.

- Optimization:

MDR were adjusted iteratively until profitability was achieved in 80% of the simulated cases, while ensuring that the rates remained competitive in the market. However, for elastic merchants who are very sensitive to MDR changes and may lead to loss of relationship, we followed the same process to arrive at optimal float level (account balance) keeping the MDR as is to maintain profitability.

- Monte Carlo Simulation for Profitability

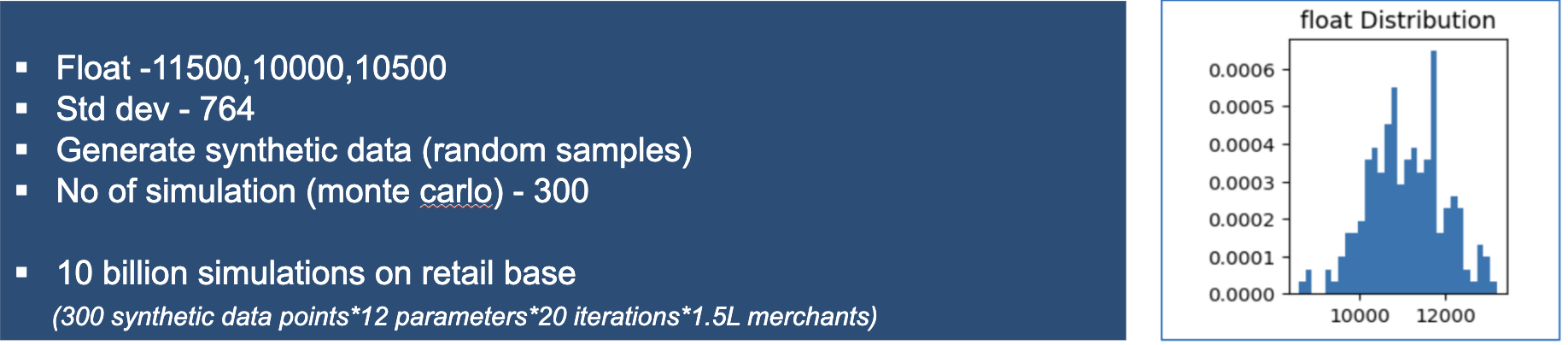

Monte Carlo simulations with Gaussian distributions were implemented to generate synthetic transaction data, modelling profitability under varying MDR. These simulations allowed us to evaluate the impact of incremental MDR changes on the overall profitability for banks.

Key stages of the simulation

-

Baseline Profit Calculation: Profitability was calculated for each merchant based on the existing MDR and transaction data.

-

Gaussian Distribution Simulation: For each variable, Synthetic data were generated to forecast future profitability under varying MDR.

example: For a merchant with 3 month float as follows, ~300 synthetic data points can be generated

- MDR optimization: Iteratively adjusting MDR for each merchant, ensuring that at least 80% of simulated scenarios resulted in positive profits for the bank, limiting MDR at an upper limit threshold to prevent uncompetitive rates compared to market competition.

Key Tools

- Linear Programming

Models profitability as a function of multiple constraints/variables

Results/Impact

A dynamic automated optimisation script that adjusts MDR based on real-time transaction data was developed.

Losses were significantly minimised by ~45% by effectively repricing MDR of relatively less proportion of merchants (92% vs 47%).